Some Ideas on Broker Mortgage Rates You Should Know

Wiki Article

Excitement About Mortgage Broker Assistant

Table of ContentsSome Known Details About Mortgage Broker Assistant Job Description An Unbiased View of Mortgage BrokerageThe Best Strategy To Use For Mortgage Broker Job Description8 Easy Facts About Mortgage Broker Job Description ExplainedHow Broker Mortgage Near Me can Save You Time, Stress, and Money.Mortgage Broker Fundamentals ExplainedThe smart Trick of Broker Mortgage Meaning That Nobody is Talking AboutNot known Details About Broker Mortgage Meaning

What Is a Home loan Broker? A home mortgage broker is an intermediary between an economic organization that supplies lendings that are safeguarded with property and also people thinking about purchasing realty who require to borrow cash in the form of a lending to do so. The home loan broker will certainly collaborate with both events to get the specific authorized for the car loan.A mortgage broker typically works with several different lenders as well as can supply a selection of car loan alternatives to the customer they function with. The broker will gather information from the private and go to several lenders in order to find the ideal prospective lending for their customer.

A Biased View of Mortgage Broker Job Description

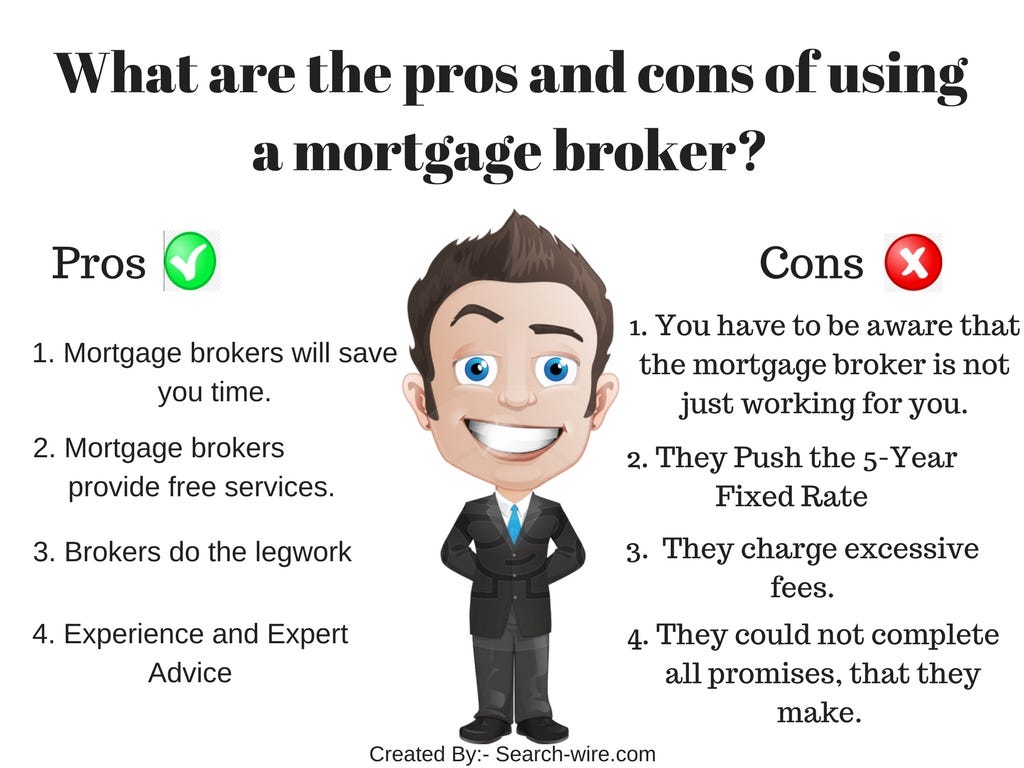

The Base Line: Do I Need A Home Loan Broker? Functioning with a mortgage broker can conserve the borrower time and initiative throughout the application process, as well as potentially a great deal of money over the life of the loan. In addition, some lenders work solely with home mortgage brokers, implying that debtors would certainly have access to financings that would certainly or else not be readily available to them.It's essential to take a look at all the charges, both those you might have to pay the broker, along with any kind of fees the broker can aid you prevent, when weighing the decision to function with a mortgage broker.

The Single Strategy To Use For Broker Mortgage Calculator

You have actually most likely listened to the term "home loan broker" from your realty agent or pals that've bought a residence. What exactly is a home loan broker and also what does one do that's different from, say, a loan officer at a bank? Geek, Wallet Overview to COVID-19Get solution to concerns concerning your home mortgage, traveling, funds as well as preserving your peace of mind.What is a home mortgage broker? A home loan broker acts as a middleman between you as well as potential lending institutions. Home loan brokers have stables of loan providers they work with, which can make your life much easier.

The smart Trick of Mortgage Broker Salary That Nobody is Talking About

Exactly how does a mortgage broker earn money? Home loan brokers are frequently paid by lenders, often by borrowers, yet, by regulation, never both. That regulation the Dodd-Frank Act additionally restricts home loan brokers from charging concealed costs or basing their settlement on a customer's rate of interest. You can additionally choose to pay the mortgage broker yourself.The competition and also home prices in your market will have a hand in determining what home loan brokers cost. mortgage broker meaning Federal regulation limits exactly how high compensation can go. 3. What makes home mortgage brokers various from car loan policemans? Financing policemans are employees of one lender who are paid set wages (plus incentives). Financing police officers can write only the types of car loans their company picks to use.

The 25-Second Trick For Broker Mortgage Fees

Home mortgage brokers might be able to offer customers accessibility to a broad selection of funding types. You can conserve time by utilizing a mortgage broker; it can take hours to use for preapproval with different loan providers, then there's the back-and-forth communication involved in financing the car loan as well as guaranteeing the deal remains on track.When selecting any loan provider whether via a broker or directly you'll desire to pay focus to loan provider costs. Particularly, ask what charges will certainly appear on Web page 2 of your Funding Quote type in the Car loan Costs area under "A: Origination Charges." Then, take the Financing Quote you receive from each loan provider, put them alongside and contrast your rate of interest price and also all of the fees and shutting prices.

An Unbiased View of Broker Mortgage Calculator

Just how do I pick a home mortgage broker? The finest method is to ask close friends and relatives for recommendations, yet make sure they have in fact made use of the broker and also aren't simply going down the name of a former university flatmate or a distant acquaintance.

How Mortgage Broker Salary can Save You Time, Stress, and Money.

Competition and mortgage broker salary house rates will affect just how much home mortgage brokers make money. What's the distinction in between a home loan broker and a lending officer? Home loan brokers will collaborate with lots of lending institutions to locate the most effective lending for your scenario. Loan police officers work for one lending institution. Just how do I discover a mortgage broker? The ideal method to find a mortgage broker is via referrals from household, buddies and your actual estate agent.

Mortgage Broker Average Salary for Dummies

Getting a new residence is one of the most complex events in an individual's life. Feature differ significantly in terms of style, services, college district and, obviously, the constantly vital "area, area, area." The home mortgage application procedure is a complex aspect of the homebuying procedure, particularly for those without previous experience.

Can establish which problems might develop problems with one lending institution versus one more. Why some customers prevent home mortgage brokers In some cases property buyers really feel extra comfy going directly to a big financial institution to protect their finance. In that instance, purchasers ought to at least consult with a broker in order to understand every one of their options pertaining to the kind of loan as well as the available price.

Report this wiki page